Why You Need To Own BAC - 20% Expected IRR With A Sufficient Margin Of Safety (NYSE:BAC) | Seeking Alpha

Why You Need To Own BAC - 20% Expected IRR With A Sufficient Margin Of Safety (NYSE:BAC) | Seeking Alpha

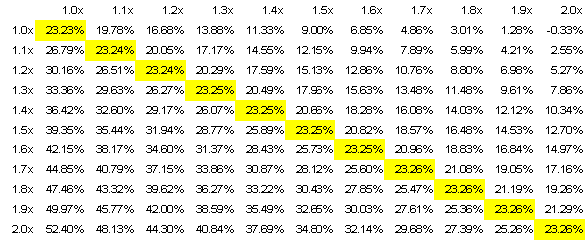

Tiho Brkan on Twitter: "The most important table for private investors. Forget tricky IRR. Focus on CAGR, MOIC & duration. Personally, I'm happy with a 2X in 5 years but aim for

![White Internal Rates of Return (with no growth) - Parry's Valuation and Investment Tables, 13th Edition [Book] White Internal Rates of Return (with no growth) - Parry's Valuation and Investment Tables, 13th Edition [Book]](https://www.oreilly.com/api/v2/epubs/9780415540476/files/Images/tbl0109.jpg)